Olivier Le Moal

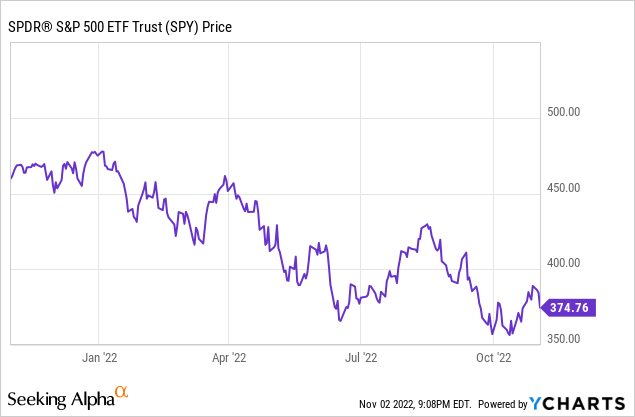

In spite of the fact that the market has recovered somewhat in recent days, it is still going through a period of extraordinary uncertainty. Though we believe that no one can accurately predict how the market is going to behave in the next week or next six months, there are enough dark clouds out there indicating a possibility of tougher times ahead.

In recent months, the market has been all about the Fed policy. As we write this, the Fed raised the short-term interest rates by 75 basis points for the fourth consecutive time. Today’s increase was widely expected and was already baked into the expectations. However, more important was the expectation of a pivot in the Fed’s policy, which did not seem to materialize. The Fed and Chairman Powell indicated that the pace of increases would likely slow, but the terminal rate would likely be higher than previously expected.

That said, irrespective of the market’s short-term movements, as long-term DGI investors, we need to pay attention to the quality of companies that we invest in and the price we pay. Naturally, it helps to buy such companies when they’re being offered relatively cheap. The goal of this series of articles is to find companies that are fundamentally strong, carry low debt, support reasonable, sustainable, and growing dividend yields, and also trade at relatively low or reasonable prices. These DGI stocks are not going to make anyone rich overnight, but if your goal is to attain financial freedom by owning stocks that should grow dividends over time, meaningfully and sustainably, then you are at the right place. We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right. Besides, we think every month, this analysis is able to highlight some companies that otherwise would not be on our radar.

This article is part of our monthly series, where we scan the entire universe of roughly 7,500 stocks that are listed and traded on U.S. exchanges, including over-the-counter (OTC) networks. However, our focus is limited to dividend-paying stocks. We usually highlight five stocks that may have temporary difficulties or lost favor with the market and offer deep discounts on a relative basis. However, that’s not the only criterion that we apply. While seeking cheaper valuations, we also demand that the companies have an established business model, solid dividend history, manageable debt, and investment-grade credit rating. Please note that these are not recommendations to buy but should be considered as a starting point for further research.

This month, we highlight three groups with five stocks each that have an average dividend yield (as a group) of 5.07%, 6.58%, and 7.50%, respectively. The first list is for conservative and risk-averse investors, while the second one is for investors who seek higher yields but still want relatively safe dividends. The third group is for yield-hungry investors but comes with an elevated risk, and we urge investors to exercise caution.

Notes: 1) Please note that when we use the term “safe” regarding stocks, it should be interpreted as “relatively safe” because nothing is absolutely safe in investing. Also, in our opinion, for a well-diversified portfolio, one should have 15-20 stocks at a minimum.

2) All tables in this article are created by the author unless explicitly specified. The stock data have been sourced from various sources such as Seeking Alpha, Yahoo Finance, GuruFocus, and CCC-List (dripinvesting).

The Selection Process

Note: Regular readers of this series could skip this section to avoid repetitiveness. However, we include this section for new readers to provide the necessary background and perspective.

Goals:

We start with a fairly simple goal. We want to shortlist five companies that are large-cap, relatively safe, dividend-paying, and trading at relatively cheaper valuations in comparison to the broader market. The objective is to highlight some of the dividend-paying and dividend-growing companies that may be offering juicy dividends due to a temporary decline in their share prices. The excess decline may be due to an industry-wide decline or some kind of one-time setbacks like some negative news coverage or missing quarterly earnings expectations. We adopt a methodical approach to filter down the 7,500-plus companies into a small subset.

Our primary goal is income that should increase over time at a rate that at least beats inflation. Our secondary goal is to grow the capital and provide a cumulative growth rate of 9%-10% at a minimum. These goals are, by and large, in alignment with most retirees and income investors, as well as DGI investors. A balanced DGI portfolio should keep a mix of high-yield, low-growth stocks along with some high-growth but low-yield stocks. That said, how you mix the two will depend upon your personal situation, including income needs, time horizon, and risk tolerance.

A well-diversified portfolio would normally consist of more than just five stocks and preferably a few stocks from each sector of the economy. However, in this periodic series, we try to shortlist and highlight just five stocks that may fit the goals of most income and DGI investors. But at the same time, we try to ensure that such companies are trading at attractive or reasonable valuations. However, as always, we recommend you do your due diligence before making any decision on them.

Selection Criteria:

The S&P 500 currently yields roughly 1.60%. Since our goal is to find companies for a dividend income portfolio, we should logically look for companies that pay yields that are at least similar to or better than the S&P 500. Of course, the higher, the better, but at the same time, we should not try to chase very high yields. If we try to filter for dividend stocks paying at least 1.50% or above, nearly 2,000 such companies are trading on U.S. exchanges, including OTC networks. We will limit our choices to companies that have a market cap of at least $10 billion and a daily trading volume of more than 100,000 shares. We also will check that dividend growth over the last five years is positive, but there can be some exceptions.

We also want stocks that are trading at relatively cheaper valuations. But at this stage, we want to keep our criteria broad enough to keep all the good candidates on the list. So, we will measure the distance from the 52-week high but save it to use at a later stage. Also, at this initial stage, we include all companies that yield 1% or higher. In addition, we also include other lower-yielding but high-quality companies at this stage.

Criteria to Shortlist:

- Market cap > $10 billion ($9 billion in a down market)

- Dividend yield > 1.0% (some exceptions are made to include high quality but lower yielding companies)

- Daily average volume > 100,000

- Dividend growth past five years >= 0.

By applying the above criteria, we got around 550 companies.

Narrowing Down The List

As a first step, we would like to eliminate stocks that have less than five years of dividend growth history. We cross-check our current list of over 550 stocks against the list of so-called Dividend Champions, Contenders, and Challengers originally defined and created by David Fish. Generally, the stocks with more than 25 years of dividend increases are called dividend Champions, while stocks with more than ten but less than 25 years of dividend increases are termed, Contenders. Further, stocks with more than five but less than ten years of dividend increases are called Challengers. Also, since we want a lot of flexibility and wider choice at this initial stage, we include some companies that pay dividends lower than 1.50% but otherwise have a stellar dividend record and growing dividends at a fast pace.

After we apply all the above criteria, we’re left with roughly 294 companies on our list. However, so far in this list, we have demanded five or more years of consistent dividend growth. But what if a company had a very stable record of dividend payments but did not increase the dividends from one year to another? At times, some of these companies are foreign-based companies, and due to currency fluctuations, their dividends may appear to have been cut in US dollars, but in reality, that may not be true at all when looked at in the actual currency of reporting. At times, we may provide some exceptions when a company may have cut the dividend in the past but otherwise looks compelling. So, by relaxing some of the conditions, a total of 69 additional companies were considered to be on our list. We call them category ‘B’ companies. After including them, we had a total of 363 (294 + 69) companies that made our first list.

We then imported the various data elements from many sources, including CCC-list, GuruFocus, Fidelity, Morningstar, and Seeking Alpha, among others, and assigned weights based on different criteria as listed below:

- Current yield: Indicates the yield based on the current price.

- Dividend growth history (number of years of dividend growth): This provides information on how many years a company has paid and increased dividends on a consistent basis. For stocks under the category ‘B’ (defined above), we consider the total number of consecutive years of dividends paid rather than the number of years of dividend growth.

- Payout ratio: This indicates how comfortably the company can pay the dividend from its earnings. We prefer this ratio to be as low as possible, which would indicate the company’s ability to grow the dividend in the future. This ratio is calculated by dividing the dividend amount per share by the EPS (earnings per share). The cash-flow payout ratio is calculated by dividing the dividend amount paid per share by the cash flow generated per share.

- Past five-year and 10-year dividend growth: Even though it’s the dividend growth rate from the past, this does indicate how fast the company has been able to grow its earnings and dividends in the recent past. The recent past is the best indicator that we have to know what to expect in the next few years.

- EPS growth (average of previous five years of growth and expected next five years’ growth): As the earnings of a company grow, more than likely, dividends will grow accordingly. We will take into account the previous five years’ actual EPS growth and the estimated EPS growth for the next five years. We will add the two numbers and assign weights.

- Chowder number: So, what’s the Chowder number? This number has been named after well-known SA author Chowder, who first coined and popularized this factor. This number is derived by adding the current yield and the past five years’ dividend growth rate. A Chowder number of “12” or more (“8” for utilities) is considered good.

- Debt/equity ratio: This ratio will tell us about the debt load of the company in relation to its equity. We all know that too much debt can lead to major problems, even for well-known companies. The lower this ratio, the better it is. Sometimes, we find this ratio to be negative or unavailable, even for well-known companies. This can happen for a myriad of reasons and is not always a reason for concern. This is why we use this ratio in combination with the debt/asset ratio (covered next).

- Debt/asset ratio: This ratio will tell us about the debt load in relation to the total assets of the company. In almost all cases, this ratio would be lower than the debt/equity ratio. Also, this ratio is important because, for some companies, the debt/equity ratio is not a reliable indicator.

- S&P’s credit rating: This is the credit rating assigned by the rating agency S&P Global and is indicative of the company’s ability to service its debt. This rating can be obtained from the S&P website.

- PEG ratio: This also is called the price/earnings-to-growth ratio. The PEG ratio is considered to be an indicator if the stock is overvalued, undervalued, or fairly priced. A lower PEG may indicate that a stock is undervalued. However, PEG for a company may differ significantly from one reported source to another, depending on which growth estimate is used in the calculation. Some use past growth, while others may use future expected growth. We’re taking the PEG from the CCC list wherever available. The CCC list defines it as the price/earnings ratio divided by the five-year estimated growth rate.

- Distance from 52-week high: We want to select companies that are good, solid companies but also are trading at cheaper valuations currently. They may be cheaper due to some temporary down cycle or some combination of bad news or simply having a bad quarter. This criterion will help bring such companies (with a cheaper valuation) near the top as long as they excel in other criteria as well. This factor is calculated as (current price – 52-week high) / 52-week high.

- Sales or Revenue growth: This is the average growth rate in annual sales or revenue of the company over the last five years. A company can only grow its earnings power as long as it can grow its revenue. Sure, it can grow the earnings by cutting costs, but that can’t go on forever.

Below we provide a table (as a downloadable Excel spreadsheet) with weights assigned to each of the ten criteria. The table shows the raw data for each criterion for each stock and the weights for each criterion, and the total weight. Please note that the table is sorted on the “Total Weight” or the “Quality Score.” The list contains 363 names and is attached as a file for readers to download:

File-for-export_-_5_Safe_and_Cheap_DGI_-_Nov_2022.xlsx

Selection Of The Top 50

We will first bring down the list to roughly 50 to 60 names by automated criteria, as listed below. In the second step, which is mostly manual, we will bring the list down to about 30.

- Step 1: We will first take the top 20 names in the above table (based on total weight or quality score).

- Step 2: Now, we will sort the list based on dividend yield (highest at the top). We take the top 10 after the sort to the final list. We only take the top two or three from any single industry segment because, otherwise, some of the segments, like energy, tend to overcrowd (selected 11 names).

- Step 3: We will sort the list based on five-year dividend growth (highest at the top). We will take the top 10 after the sort to the final list (selected ten names).

- Step 4: We will then sort the list based on the credit rating (numerical weight) and select the top 10 stocks with the best credit rating. However, we only take the top two or three from any single industry segment because, otherwise, some of the segments tend to be overcrowded (selected 11 names).

- Step 5: We will also select ten names that have the largest discount from their 52-week highs as long as they meet other criteria.

From the above steps, we had a total of 62 names in our final consideration. The following stocks appeared more than once:

Appeared two times:

AVGO, BBY, MSFT, NEM, SWK, TROW, VALE, VFC (8 duplicates)

After removing eight duplicates, we are left with 54 (62-8) names.

Since there are multiple names in each industry segment, we will just keep a maximum of three or four names from the top of any one segment. We keep the following:

Financial Services, Banking, and Insurance:

Banking:

Financial Services – Others: (TROW), (BEN), (V)

Insurance: (OTCQX:ZURVY)

Business Services/ Consulting:

(ADP)

Conglomerates:

Industrials:

Transportation/ Logistics:

(UPS)

Chemicals:

Materials/Mining/Gold:

Materials:

Mining (other than Gold): (VALE), (BHP), (RIO)

Gold: (NEM)

Defense:

None

Consumer/Retail/Others:

Cons-defensive:

Cons-discretionary: (NKE), (AAP), (VFC)

Cons-Retail: (TGT), (LOW), (BBY), (BBY)

Communications/Media:

Healthcare:

Healthcare Ins: (CI)

Technology:

(MSFT), (AVGO), (QCOM), (AMAT), (TXN)

Energy:

Pipelines/ Midstream: (ENB), (MPLX), (MMP)

Oil & Gas (prod. & exploration): (CVX), (XOM), (FANG)

Utilities:

(NRG)

Housing/ Construction:

(LEN)

REIT:

Final Step: Narrowing Down To Just Five Companies

This step is mostly a subjective one and is based solely on our perception. The readers could certainly differ from our selections, and they may come up with their own set of five companies with a target yield, but they should pay attention to keeping the group diversified among different sectors or industry segments. Below, we make three lists for different sets of goals, dividend income, and risk levels. We try to make each of the groups highly diversified and try to ensure that the safety of dividends matches the overall risk profile of the group. Nonetheless, here are our three final lists for this month:

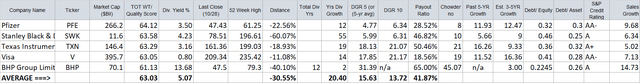

Final A-List (Conservative Safe Income):

Average yield: 5.07%

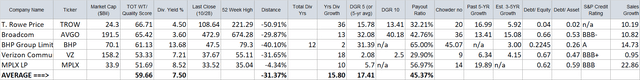

Table-1A: A-LIST (Conservative Income)

DGI A-List (Author)

We think this set of five companies (in the A-List) would form a solid diversified group of dividend companies that would be appealing to income-seeking and conservative investors, including retirees and near-retirees. The average yield is very attractive at 5.07% compared to less than 1.6% of the S&P 500. The average dividend history is roughly 20 years, and the average discount from a 52-week high is very attractive for these stocks at -30%.

This month’s A-List is for moderately conservative investors. The yield is very attractive at 5.07%. However, this may come down to the 4.5% range if one of the stocks in the list (especially BHP) reduces its dividend payout. If you must need even higher dividends, consider B-List or C-List, as presented below.

SWK (Stanley Black & Decker): This stock makes it to our A-list and B-list. The company’s stock price was hammered in the year 2022. It is trading nearly 60% below its 52-week highs, and its valuation looks cheap. At this point, it is a bit of a turnaround story. It faced headwinds resulting from supply chain issues and higher freight costs, and subsequently from high levels of inventories. The biggest risk with SWK comes from China, as it has most of its manufacturing over there. Any geopolitical tensions or, worse, a hot war between China and the US (an extreme possibility) could have very serious negative impacts on the company. On the positive side, the company has paid increasing dividends for 55 years, and the payout ratio is still very reasonable in spite of the current headwinds. It is likely to keep providing stable dividends (at 4.20% yield) while we wait for turnaround and improvements in valuations. More active investors could also write call options to generate more income.

BHP Group: The company’s stock is generally more volatile because of the nature of its business. It had a tremendous year in 2022 because of high commodity prices. Going forward, the demand outlook may decline a bit, but overall the demand for commodities that BHP produces is likely to remain strong as more and more people move into the middle class in the developing world. Exploration and supply growth will remain constrained due to factors like environmental regulations and the ESG framework. The current valuation and the yield are very attractive. All that said, it is likely that the company will reduce the dividend payout in the future (likely in 2023), by some estimates, as much as 25% to 50%. Some of the dividend reduction is already baked into the price. Even then, the future yield will still be very attractive (at around 7% to 10% on current prices). It will be best to buy this in two lots, one now and one later, if the prices drop significantly from current levels due to dividend reduction. This month, BHP made it to all three of our lists.

TXN (Texas Semiconductor) and V (Visa): We have included two growth names from the Tech (Semiconductor) and Finance sectors, respectively. Visa provides a minuscule yield but is likely to provide high dividend growth and price appreciation.

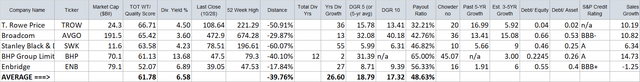

Final B-List (High Yield, Moderately Safe):

Average yield: 6.58%

Note 1: Very often, we include a few low-risk stocks in B-List and C-list. Also, oftentimes, a stock can appear in multiple lists. This is done on purpose. We try to make each of our lists fairly diversified among different sectors/industry segments of the economy. We try to include a few of the highly conservative names in the high-yield list to make the overall group much safer.

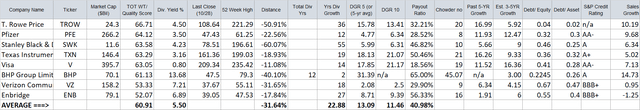

Table-1B: B-LIST (High Yield)

DGI B-List (Author)

In the B-List, the overall risk profile of the group becomes slightly elevated compared to A-List. That said, the group will likely provide safe dividends for many years.

AVGO (Broadcom): We have included AVGO here in place of TXN (in the A-List). AVGO definitely has more risk than TXN but also offers higher dividend and growth prospects. The risk comes from its aggressive acquisition strategy, which has worked well in the past. Its most recent acquisition (pending) of VMWare for $60 Billion will add quite a bit of additional debt but would diversify more heavily in the software business.

This list offers an average yield for the group of 6.58%, an average of 26 years of dividend history, and high dividend growth. In this list, all five positions offer very good discounts compared to their 52-week highs, and the average discount is -39%.

Final C-LIST (Yield-Hungry, Less Safe):

Average yield: 7.50%

Notes:

Note 1: Oftentimes, a stock can appear in multiple lists. We try to include one or two conservative names in the high-yield list to make the overall group much safer.

Note 2: MPLX is a Mid-stream Partnership and issues the K1 tax form instead of 1099-Div (for corporations).

Table-1C: C-LIST (Yield-Hungry, Elevated Risk)

DGI C-List (Author)

Apparently, this list (C-List) is for yield-hungry DGI investors, so we urge due diligence to determine if it would suit your personal situation. Nothing comes for free, so there will be more risk involved with this group. That said, it’s a highly diversified group spread among five different sectors.

Please see our note on BHP above (A-List section).

We have added another high-yielding stock, VZ (Verizon). Usually, VZ would be considered a conservative dividend stock, but due to the very high debt burden in a high-interest rates environment and slowing growth has caused the stock to crater nearly 27% this year. We feel the stock is offering a much better valuation and a very attractive dividend yield at these levels.

We may like to caution that each company comes with certain risks and concerns. Sometimes these risks are real, but other times, they may be a bit overblown and temporary. So, it’s always recommended to do further research and due diligence.

What If We Were To Combine The Three Lists?

If we were to combine the three lists, after removing the duplicates (because of combining), we would be left with ten unique names. However, we will also remove one of the names from ENB and MPLX, as they both come from the same segment. We keep ENB. On the same principle, we keep TXN and remove AVGO. We are now left with 8 (eight) names. The combined list is highly diversified in many industry segments. The stats for the group of 8 are as follows:

Average yield: 5.50%

Average discount (from 52WK High): -31.6%

Average 5-Yr dividend growth: 13.9%

Average Quality Score: 60.91

Table 2:

DGI Combined (Author)

Conclusion

In the first week of every month, we start with a fairly large list of dividend-paying stocks and filter our way down to just a handful of stocks that meet our selection criteria and income goals. In this article, we have presented three groups of stocks (five each) with different goals in mind to suit the varying needs of a wider audience. Even though the risk profile of each group is different, each group in itself is fairly balanced and diversified.

The first group of five stocks is for conservative investors who prioritize the safety of the dividend and the preservation of their capital. The second group reaches for a higher yield but with only a slightly higher risk. However, the C-group comes with an elevated risk and is certainly not suited for everyone.

This month, the first group yields 5.07%, while the second group elevates the yield to 6.58%. We also presented a C-List for yield-hungry investors with a 7.50% yield. The combined group (all three lists combined and duplication removed) offers an even more diversified group with a 5.50% yield.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Top Stock To Invest – My Blog https://ift.tt/u4yoKs2

via IFTTT

Keine Kommentare:

Kommentar veröffentlichen